The story of Airbnb’s early days lends credence to this maxim. When Brian Chesky and Joe Gebbia pitched their idea of a service that would offer people accommodation in random homes instead of hotels, investors decided it was a bad idea and refused to fund their startup. Paul Graham of Y Combinator also thought it was a bad idea but he put down the money to help the founders run the business.

Why? He was convinced the guys would at least be smart enough to pivot to a reasonable venture when reality had rid them of their delusion. He believed in the founders enough to invest even if their idea was doubtful. Today, that bad idea has a valuation of $80 billion! The startup’s success is perhaps a combination of many factors, but the attributes of the founders contributed to raising the necessary funding in the first place.

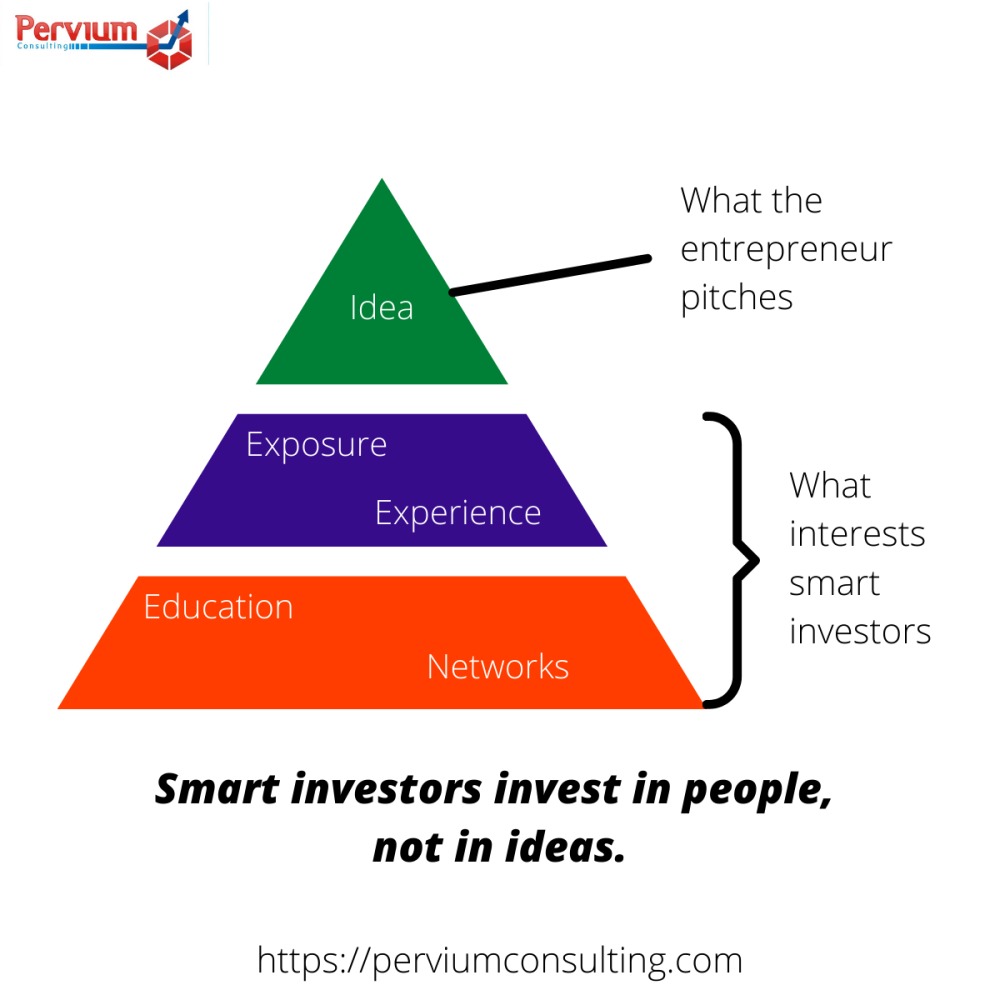

Entrepreneurs Focus on Ideas, Smart Investors Want to Know More

Many entrepreneurs swear by their ideas. They think their ideas will change the world. And they guard these ideas with all they have, protecting them, nursing them, waiting for the smart investor. They are certain the smart investor will jump at financing their super ideas as soon as he or she hears them.

While these investors truly want to hear those great ideas, they are more particular about the person (and increasingly the people) pushing the idea. They are more interested in the entrepreneur’s history, their exposure and experience, their education and networks. They want to know about the person’s capacity, character, and competence. Investors want to know what they have been able to achieve in the past because past success could be a predictor of future success. Beyond ideas, investors are keen on the entrepreneur’s ability to execute.

You can begin to take certain steps to become that prime candidate smart investors are looking for no matter where you are on your entrepreneurial journey.

Pay Attention to Your Growth

So, what do you need to do? Focus on building your three Cs — Your Competence, Character, and Capacity.

1. Competence: Keep learning, keep developing the right skills to do the job. This includes not just technical skills relatable to your specialty but entrepreneurial and business skills as well. Take courses in marketing, finance, leadership, or even public speaking. Take an inventory of your skills and begin to bridge your competence gap.

2. Character: Pay attention to your attitudes, values, and priorities. Be your authentic self, but above all strive to inculcate the disciplines and habits for success. Do you value delivering on your promises? Are you a person of integrity striving to do as you say? What do the values of integrity, respect, collaboration, and perseverance mean to you?

3. Capacity: Your competence and character naturally lead to building your capacity. How much of what you can do are you able to do? It refers to your stamina–physical, mental, psychological, essentially how far you can keep going under the demands of work and responsibility.

The good thing about all these traits is that you can learn, grow, and improve in all three dimensions as you address them. This is the way to develop qualities as a person who brings value to the table. Certain ideas will only occur to you as you grow in those three areas.

Teams Offer Confidence

Just a note on teams: Investors feel more comfortable with teams of founders than with single stars. They want to know that critical roles such as product development, marketing, and finance are manned by competent members of a founding team. The team’s competence is a reflection of each member’s competence. A mediocre team can take a good idea and create nothing significant of it. But a good team can take a plain, obvious-to-the-eye, plain-as-vanilla idea and make an empire of it.

Members of a team are able to complement one another thereby presenting a strong case to investors. That is another reason to pay attention to your personal growth. It becomes easier to attract smart people to yourself as you grow.

In conclusion, great ideas only translate to value with the right execution. It takes the right mix of competence, character, and capacity to take an idea from concept to value delivery. Smart investors know this, which is why they invest in people, and not in ideas.